Michel Dominicé, Senior Partner

Article published in French and German in IMMO25, p.22

As 2025 begins, several major events are shaking up the Swiss mortgage market. Credit is becoming scarcer, and margins are increasing. Are these phenomena temporary or long-lasting? What might happen if negative interest rates return? Let’s take a closer look.

A Changing Environment

In recent years, a series of events has led to the reappearance of positive interest rates and an increase in banking margins as a consequence.

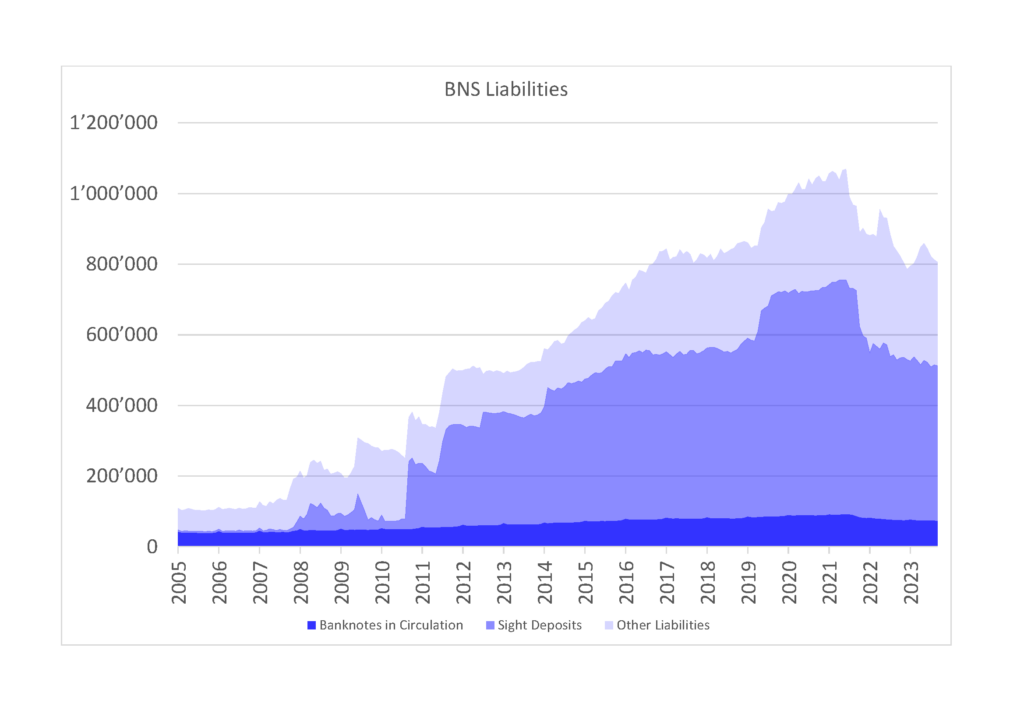

After more than seven years of negative rates, during which banks offered low-margin mortgages to minimize their excess deposits with the Swiss National Bank (SNB), 2022 marked the return of positive rates, disrupting the mortgage market.

Simultaneously, COVID-19 lockdowns drove households to save more, providing banks with a funding source for loans. As normalcy returned, these savings diminished. While some banks still hold surplus reserves, others are struggling to attract sufficient deposits to finance their lending.

In 2023, the merger of UBS and Credit Suisse further concentrated the Swiss banking sector. This reduction in competition prompted UBS to scale back its mortgage offerings to rebalance its balance sheet. This move influenced other banks, which also tightened their issuance of mortgage loans.

Read also: Transition to real estate funds |

…commercial banks currently hold excess liquidity with the SNB, amounting to 13 times the required minimum reserves—far exceeding the 4% mandated by the new regulations. However, with the anticipated return of negative interest rates, this surplus liquidity could incentivize banks to lend more, leading to increased competition, reduced margins, and consequently, more accessible credit.

New Regulations

In response to this evolving environment, two new regulations have been implemented to enhance the stability of commercial banks:

- Strengthening Minimum Reserves:

Since July 2024, the SNB has increased minimum reserve requirements from 2.5% to 4% of liabilities while expanding their definition. These non-remunerated reserves act as a tax on deposits. While this does not directly affect mortgage lending, banks compensate for this reduced profitability by increasing their margins on loans. - Implementation of Basel III:

Starting January 2025, Basel III requirements will come into effect, requiring banks to strengthen their capital reserves, making mortgage lending more capital-intensive. To maintain profitability, banks will need to increase their margins on real estate loans.

A Temporary or Permanent Trend?

Although it seems likely that elevated margins will persist, several indicators suggest the situation might change. Which ones?

As shown in the attached graph, commercial banks currently hold excess liquidity with the SNB, amounting to 13 times the required minimum reserves—far exceeding the 4% mandated by the new regulations. However, with the anticipated return of negative interest rates, this surplus liquidity could incentivize banks to lend more, leading to increased competition, reduced margins, and consequently, more accessible credit.

In the short term, however, the upward pressure on banking margins is expected to persist, ushering in a new era for borrowers and real estate investors in Switzerland.

Read also: Towards a Return of Negative Interest Rates in Switzerland |